Customer feedback is crucial to KFC’s success. The MyKFCExperience Survey is an online feedback program for customers. Using this survey, they can determine the level of satisfaction of people who have visited one of their restaurants.

Kentucky Fried Chicken conducts its MyKFCExperience customer survey nowadays so they can collect reviews with regards to the quality of food products and atmosphere that they are providing. KFC then collects all customer reviews and works to improve their services and products as a result.

Or

If you recently visited a KFC outlet, you are eligible to take the survey. Your receipt must be valid to take the survey. However, if you have a valid receipt, you can take the survey and win amazing rewards. If you find that an outlet isn’t performing up to expectations, you can easily leave a complaint at the MyKFCExperience feedback. You can also leave positive feedback if you liked the services offered.

If any concerns or suggestions are found to be valid by the MyKFCExperience online survey evaluators, they will be immediately addressed. If the outlet has undergone any necessary changes, you may notice them during your next visit. KFC will give each survey-taker a free chicken Go cup the next time they visit the restaurant.

MyKFCExperience.com Survey Participation Instructions

Following the below-given step-by-step instructions, all eligible customers can complete the MyKFCExperience online survey.

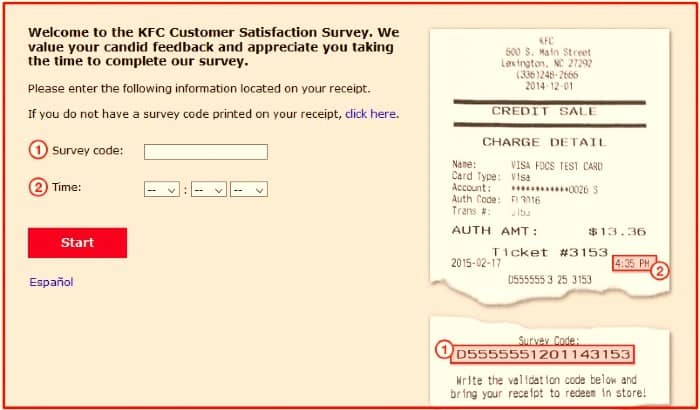

- Go to www.mykfcexperience.com by typing it in your browser or clicking on the link.

- The survey website will ask you for the MyKFCExperience Survey Code and the time of the transaction on your receipt. Enter the information and click “Start.”

- It is still possible to take the MyKFCExperience Survey if your receipt does not have a survey code. You will be transferred to another page by clicking the blue “Click Here” link above the MyKFCExperience Survey Code field.

- Please provide the following information: Store Number, Date and Time of Purchase, and the Ticket Number.

- After you have entered all the information requested, you may begin the MyKFCExperience customer survey.

- Your satisfaction with KFC during the most recent visit is the focus of all questions. You should be as truthful and specific as possible about both the positives and the negatives of your experience.

- Following the survey, you will be asked if you would like to enter the sweepstakes draw, where the winner will receive a $1,000 prize. Getting an entry is optional, but you will be required to supply your name and contact details if you choose to do so.

- After your KFC validation code has been generated, it will appear on the screen. For a free KFC Go Cup, write your code on the back of your receipt, and present it at any KFC restaurant nationwide.

My KFC Experience Survey Restrictions

- If you are under 18, regardless of your country of origin, you cannot take the My KFC Experience survey.

- The survey is not open to anyone connected to KFC in a professional capacity, including family members of employees and investors.

- You are not permitted to give a free chicken voucher to anyone else if you win it in the MyKFCExperience survey. In addition, only one person can take advantage of the offer at a time.

- Your MyKFCExperience customer survey access request will be denied if you visited the outlet more than one month ago. You must have a KFC receipt from the past month.

MyKFCExperience Survey Reward

You might be wondering what KFC Survey has to offer. The KFC deals are definitely worth checking out if you are a KFC fan. You will receive a coupon at the end of the My KFC Experience Customer Survey if you complete MyKFCExperience. Customers can get a free KFC Go Cup when they purchase any drink with this coupon. And there’s more! In addition, you can enter the sweepstakes draw, where one lucky winner will receive $1,000.

KFC Go Cup is the “perfect on-the-go snack” in a handy-sized cup that contains KFC’s signature dishes such as Chicken Little Wings, Original Recipe Bites, Hot Wings, Original Recipe Boneless, and Extra Crispy Tenders.

KFC Customer Satisfaction Survey Requirements

- The www.mykfcexperience.com website may be accessed from anywhere, but only citizens of the United States, the United Kingdom, Canada, New Zealand, and the Philippines will receive the free Go cup.

- You should have visited KFC recently. This is because you will be asked to enter a unique MyKFCExperience Survey Code and the time when you visited the site. If either of those entries does not match, you will not be able to access the survey.

- If you are applying to a Spanish or English course, you must know both languages.

- It is recommended that you have access to the internet via a computer, laptop, or smartphone.

Questions Asked in KFC Customer Satisfaction Survey

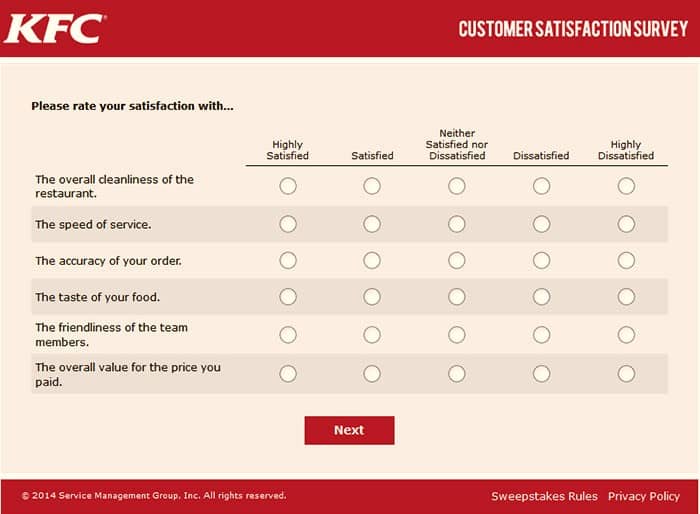

The MyKFCExperience online survey only takes a few minutes to complete. Visit the official website to complete the survey. The survey asks the following questions:

- The first question of the MyKFCExperience will ask you to rate your overall experience at KFC on a scale between 1 and 5.

- Confirm your order type, such as takeout, dine-in, carryout, or catering.

- The next question asks you to rate your satisfaction on the basis of:

- Restaurant cleanliness

- The speed of service

- Food quality

- The friendliness of the staff

- Order accuracy.

- You will be asked if you had any problems while at the restaurant in the next question.

- Next, you will be asked if you plan on returning to KFC or recommending it to someone else in the coming 30 days.

- Your next question will ask you to explain why you are highly or less satisfied with KFC in 1200 words.

- After this, you will be asked whether there were any remaining items in your order.

- On a scale of 1 to 5, rate some of the other aspects of your food.

- Is there anything that went wrong during your visit or not? Also, if there was any problem, how well it was resolved.

- Finally, enter your personal information & press submit to get the Free KFC Coupon code.

Why MyKFCExperience Customer Satisfaction Survey?

KFC is one of the most trusted food franchises in the world. KFC is usually the first brand that comes to mind when we think of fast-food chicken. KFC currently has branches in over 150 countries worldwide. The company was founded over seven decades ago. Even if a corporation were incredibly efficient, it would be impossible to run all KFC outlets successfully. The customers can assist in this effort.

Unlike any other survey, the MyKFCExperience online survey is incredibly thorough. Nevertheless, answering the questions won’t take you much time since you simply need to choose from multiple-choice answers. You can also write down your concerns in the comments section if your concern still remains unaddressed. Additionally, each survey taker can get a free chicken Go cup when they visit their favorite outlet after completing the MYKFCExperience customer survey.

| Official Name | MyKFCExperience |

|---|---|

| Country | USA |

| Conducted By | KFC |

| Primary Objective | Collect Customer Feedback |

| Age Requirements | 18+ |

What Are The Survey Objectives?

MyKFCExperience is designed primarily to measure customer satisfaction. When a customer is satisfied, the restaurant’s brand image will improve, while negative feedback will lead them to improve their services. In addition to achieving these main goals, this survey also aims to accomplish several other objectives, which will be discussed below:

- KFC can use MyKFCExperience to determine which outlets are performing best and improve them if necessary.

- The restaurant takes customer feedback into account when improving its offerings.

- Being able to feel like top management is listening to customers boosts their confidence.

- A company can improve its brand image by conducting such surveys because it wants to improve so its customers receive the best service.

- Furthermore, loyalty increases as the brand become more trusted by its customers.

- Cleaning and food safety has improved, resulting in a positive change in the quality of services.

- Lastly, customers can win exciting prizes, so they don’t hesitate to refer others to this survey.

About KFC

The Kentucky Fried Chicken chain is a fast-food restaurant in America. It has its headquarters in Louisville, Kentucky. Fried chicken is its specialty. McDonald’s is the second-largest restaurant chain in the world. As of its most recent statistics, over 22,621 locations are operating globally in 150 countries.

In the U.S., KFC was founded in 1952 by Colonel Harland Sanders, a businessman who began selling fried chicken in Kentucky during the Great Depression. The first franchise opened in Utah in 1954. Fast-food giant KFC made chicken famous by competing with and challenging the already established dominance of hamburgers, diversifying the market.

The company’s main products include chicken burgers, wraps like Twisters, and a variety of finger foods, such as chicken strips and crispy hot wings. Featuring chunks of fried chicken, Popcorn Chicken is one of the most popular KFC products.

Frequently Asked Questions

How do I participate in the MyKFCExperience Customer Survey?

To participate in the MyKFCExperience survey, visit the official website MyKFCExperience.com, provide your feedback, answer all questions, provide personal information and submit the survey.

How does the MyKFCExperience customer survey help you?

You will receive a code after submitting your survey, which you can use to get some prizes.

Closing Remarks

KFC serves tasty fried chicken and fries. The restaurant will be able to improve on its food items and services as a result of your feedback. Furthermore, the KFC restaurant kept an online portal for MyKFCExperience, i.e., www.mykfcexperience.com. Participants can complete online surveys to win a free cup of chicken.

If you are experiencing any difficulty while using the www.mykfcexperience.com website, you should first check your Internet connection or clear your browser cookies to resolve the issue. Alternatively, you can contact (800) 225-5532 for more information and better customer service.